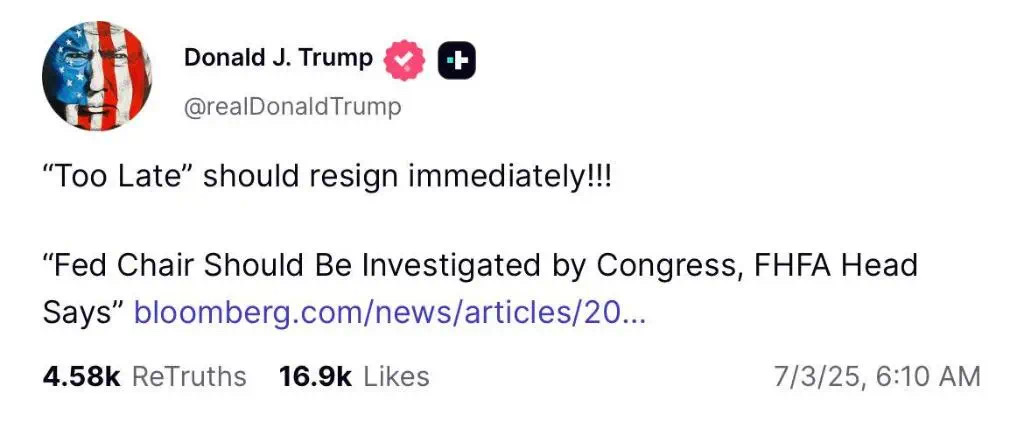

As of 08:23 PM HKT on Thursday, July 3, 2025, the financial and political landscapes have been rocked by a provocative move from President Donald Trump. On July 2, 2025, Trump took to his Truth Social platform to repost a Bloomberg article calling for an investigation into Federal Reserve Chairman Jerome Powell, appending a sharp critique: “‘Too Late (sir)’ should immediately resign!!!” This latest escalation in the ongoing feud between Trump and Powell underscores a contentious battle over monetary policy, the independence of the Federal Reserve, and the intersection of political pressure with economic governance. This article provides a comprehensive examination of the context, implications, and critical perspectives surrounding this development.

Context of the Feud

The animosity between Trump and Powell has simmered since Trump appointed Powell as Fed Chairman in 2017, only to later express regret over the decision. The current flare-up stems from Powell’s refusal to lower interest rates in line with Trump’s demands, a stance Powell has defended as necessary to manage inflation risks exacerbated by the President’s tariff policies. Trump’s July 2 post follows a handwritten note sent on July 1, urging Powell to cut rates “by a lot” and accusing him of costing the U.S. “a fortune” due to high borrowing costs. The reposted Bloomberg article, authored by Federal Housing Finance Agency Director Bill Pulte, alleges deceptive testimony by Powell regarding a $2.5 billion renovation of the Fed’s headquarters, citing luxurious features like a VIP dining room and marble table as evidence of mismanagement.

This narrative gained traction when Pulte, on July 2, called for a Congressional investigation into Powell’s “political bias” and “deceptive Senate testimony,” suggesting grounds for removal “for cause.” Trump’s endorsement of this call, with the derisive nickname “Too Late,” reflects his long-standing frustration with Powell’s cautious approach, contrasting it with rate cuts by other central banks like the European Central Bank.

Implications for Monetary Policy and Fed Independence

Trump’s demand for Powell’s immediate resignation raises significant questions about the Federal Reserve’s autonomy, a cornerstone of U.S. economic stability. The Fed’s mandate to balance inflation and employment is intended to be insulated from political interference, a principle Powell has repeatedly emphasized. However, Trump’s actions—amplified by his administration’s public pressure and hints at naming a “shadow” Fed chair—challenge this independence. Legal experts note that the Supreme Court signaled in June 2025 that Trump lacks the authority to dismiss Powell before his term expires in May 2026, yet the President’s rhetoric persists, potentially influencing market perceptions and investor confidence.

The timing of this escalation is critical. With the Fed’s next policy meeting scheduled for late July, Powell’s testimony on June 25 indicated a “wait-and-see” stance, citing uncertainty from Trump’s tariffs. Posts found on X suggest a polarized investor sentiment: some view Powell’s caution as prudent given inflation risks above the 2% target, while others align with Trump, arguing that lower rates could stimulate growth. This division could destabilize financial markets if Trump’s pressure campaign intensifies, particularly if he names a successor prematurely, an unprecedented move that could weaken the dollar and raise long-term interest rates.

Political and Economic Motivations

Critically examining the establishment narrative, Trump’s attack may serve multiple agendas beyond economic policy. His criticism of Powell coincides with broader political maneuvering, including his role as an advisor in the Department of Government Efficiency (DOGE) and tensions over the “One Big Beautiful Bill Act,” which Elon Musk has opposed. The renovation scandal, while unproven, provides a convenient cudgel to discredit Powell, aligning with Trump’s narrative of bureaucratic waste. This suggests a strategic use of the Fed chair’s position to deflect from domestic policy challenges or bolster his image as a decisive leader.

Economically, Trump’s push for rate cuts reflects his belief that high rates hinder his administration’s growth agenda, especially amidst a trade war that has delayed rate reductions. However, Powell’s stance—that tariffs could raise inflation—challenges this view, supported by the International Monetary Fund’s warning of reversed global trade growth. The contradiction between Trump’s tariff-driven inflation risks and his call for lower rates highlights a potential misalignment, raising doubts about the coherence of his economic strategy.

Industry and Public Reaction

The financial sector has responded with caution. House Judiciary Chairman Jim Jordan indicated openness to investigating Powell, though no formal action has been confirmed. Meanwhile, White House Press Secretary Karoline Leavitt’s display of Trump’s note on June 30 signals official backing, intensifying the public nature of the feud. Posts on X reveal a mix of support for Trump’s demand—citing Powell’s alleged mismanagement—and skepticism, with some users questioning the legality and wisdom of forcing a resignation.

Public sentiment, as reflected in media coverage, is divided. Supporters of Trump argue that Powell’s tenure has been marked by missteps, including the slow response to post-pandemic inflation. Critics, however, warn that political interference could erode the Fed’s credibility, potentially leading to volatile markets or a loss of foreign investor trust. The renovation controversy, while sensational, lacks substantiated evidence of malfeasance, suggesting it may be a politicized distraction rather than a substantive issue.

Future Outlook and Critical Considerations

Looking ahead, the outcome of this standoff will hinge on several factors. If Congress pursues an investigation, it could pressure Powell to adjust his stance or resign voluntarily, though legal barriers remain. Alternatively, Trump may accelerate plans to name a successor, risking market disruption. The July FOMC meeting will be a pivotal moment, with Powell’s decision on rates likely to fuel further debate.

Critically, the establishment narrative of Powell as a steadfast guardian of economic stability must be questioned. His handling of inflation and tariffs has drawn legitimate critique, yet Trump’s approach risks undermining a system designed to prevent short-term political gains from overriding long-term economic health. The renovation scandal, while exaggerated, may reflect broader accountability issues within the Fed, warranting independent review rather than partisan attacks.

For investors, this saga underscores the need to monitor political developments alongside economic data. A resignation could lead to short-term volatility, with potential gains if a rate-friendly chair is appointed, or losses if markets perceive a loss of credibility. Stakeholders should also watch for regulatory responses, as the PBOC’s recent AML rules (effective August 1, 2025) highlight a global trend toward tighter financial oversight, which could intersect with U.S. policy shifts.

Conclusion

Trump’s July 2 repost and call for Powell’s resignation mark a significant escalation in a feud rooted in divergent economic visions and political ambitions. While the Fed’s independence remains legally protected, the public nature of this conflict threatens to erode institutional trust and market stability. The renovation investigation, though unproven, serves as a lightning rod for broader discontent, necessitating a balanced approach to scrutiny. As the situation evolves, the interplay of politics and economics will test the resilience of U.S. financial governance, with implications that extend beyond the current administration.