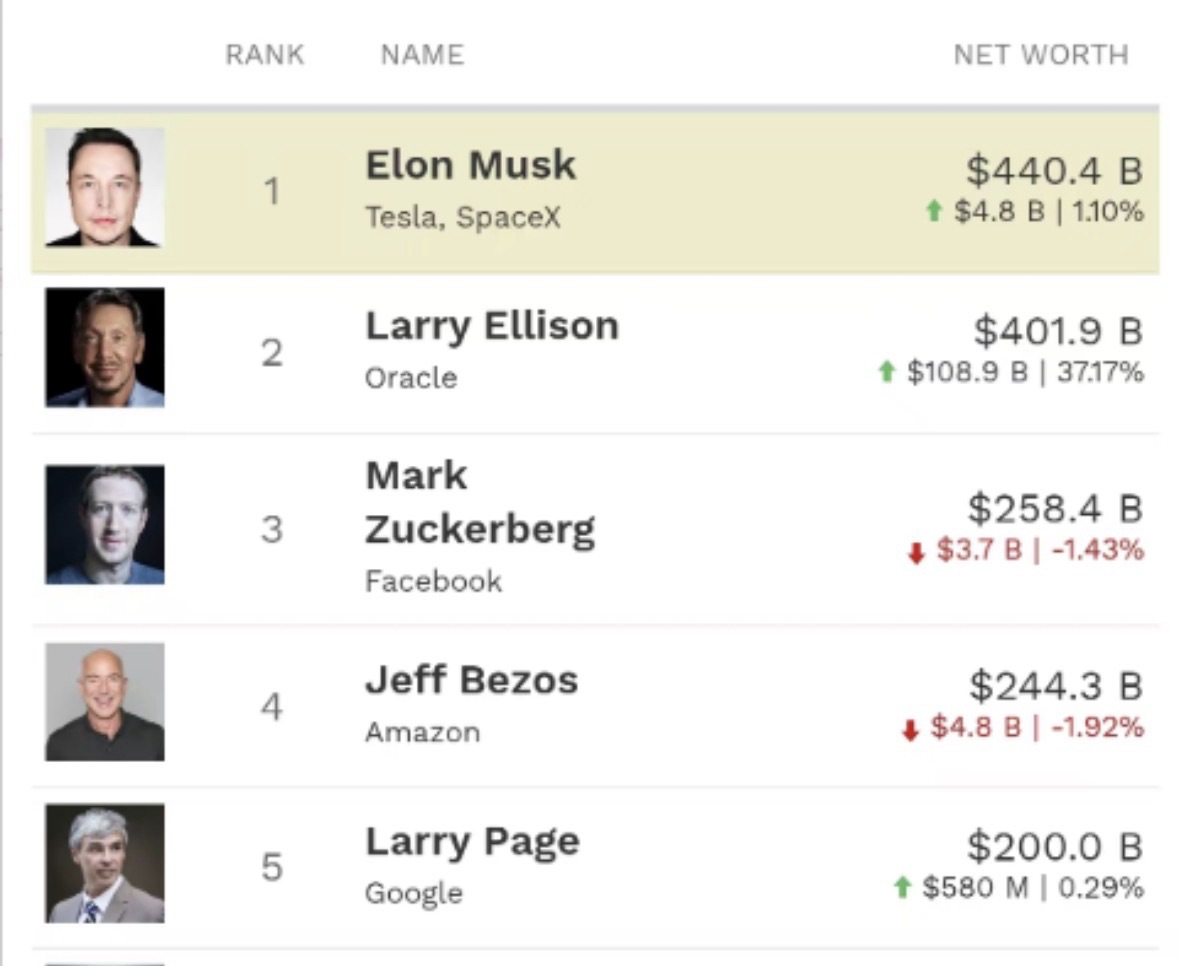

According to the Forbes Real-Time Billionaires List, Larry Ellison, co-founder of Oracle Corporation, has achieved a net worth of $401.9 billion, propelled by a staggering $110 billion single-day increase, reflecting a 37% surge. This milestone positions Ellison as the second individual in history to surpass the $400 billion wealth threshold, following Tesla and SpaceX CEO Elon Musk, whose fortune stands at $440.4 billion. The unprecedented wealth spike underscores Ellison’s enduring influence in the technology sector and Oracle’s robust market performance.

Driving Forces Behind the Wealth Surge

Ellison’s wealth surge is primarily attributed to a remarkable rally in Oracle’s stock price following the announcement of its fiscal 2026 first-quarter results on September 9, 2025. Oracle reported a remaining performance obligation (RPO) of $455 billion, a 359% year-over-year increase, signaling robust demand for its cloud computing and enterprise software solutions. On the same day, Oracle’s stock soared over 42% at the opening of U.S. markets, achieving an all-time high. This propelled Ellison’s personal fortune by $101 billion in a single day, setting a record for the largest daily wealth gain in the Bloomberg Billionaires Index.

Oracle’s strategic pivot toward cloud computing has been a key driver of Ellison’s wealth growth. The company has strengthened its position in the global cloud infrastructure market, competing fiercely with industry giants through innovations in database technology, cloud services, and artificial intelligence. Analysts highlight Oracle’s focus on security, performance optimization, and partnerships with global enterprises as critical factors in its market dominance.

Larry Ellison: From Tech Pioneer to Wealth Icon

At 81, Larry Ellison remains a towering figure in the technology industry. Having co-founded Oracle in 1977, he transformed it into a global leader in database software. Although he stepped down as CEO in 2014, Ellison continues to shape the company’s strategic vision as chairman and chief technology officer. The bulk of his wealth stems from his substantial Oracle stock holdings, complemented by strategic investments in real estate, yacht racing, and other ventures, reflecting his multifaceted approach to wealth creation.

Ellison’s wealth briefly propelled him to the top of the Bloomberg Billionaires Index with an estimated $393 billion, surpassing Musk’s $385 billion, though Forbes continues to rank Musk as the world’s richest. This “richest person” debate highlights the complexities of wealth valuation and the immense influence of tech titans in the global economy.

Tech Industry Fuels Billionaire Wealth Boom

Ellison’s milestone is part of a broader wealth surge among technology billionaires. In 2024, the world’s 500 richest individuals saw their collective wealth exceed $10 trillion, driven largely by the tech sector. Alongside Ellison, figures like Elon Musk, Mark Zuckerberg, and Jensen Huang have benefited from a 28.64% rise in the Nasdaq index in 2024, creating a favorable environment for tech-driven wealth accumulation.

Ellison’s achievement underscores the transformative power of innovation and market foresight. “We’ve never stopped innovating—that’s the key to Oracle’s success,” he once remarked, a philosophy that has defined his decades-long career and serves as an inspiration for entrepreneurs worldwide.

Looking Ahead

As Oracle continues to expand its footprint in cloud computing and artificial intelligence, Ellison’s wealth and influence are poised for further growth. Market analysts anticipate that Oracle will capitalize on the global digital transformation trend, reinforcing its position as a tech powerhouse. Ellison, often described as a “perennial innovator,” is likely to continue shaping the industry and the global wealth landscape.

This historic wealth milestone is not just a personal triumph for Ellison but a testament to the enduring impact of technology-driven innovation on the global economy.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Wealth estimates may vary due to differences in methodologies. Data is sourced from the Forbes Real-Time Billionaires List, Bloomberg Billionaires Index, and reports from financial media outlets.