Beijing, August 24, 2025 – Chinese AI startup DeepSeek has unveiled an upgraded version of its large language model, DeepSeek-V3.1, which includes optimizations specifically tailored for compatibility with forthcoming “next-generation” domestic semiconductors. This development hints at an imminent breakthrough in China’s semiconductor industry, potentially enabling widespread adoption of homegrown chips amid escalating U.S. export restrictions on advanced technology. 15 16

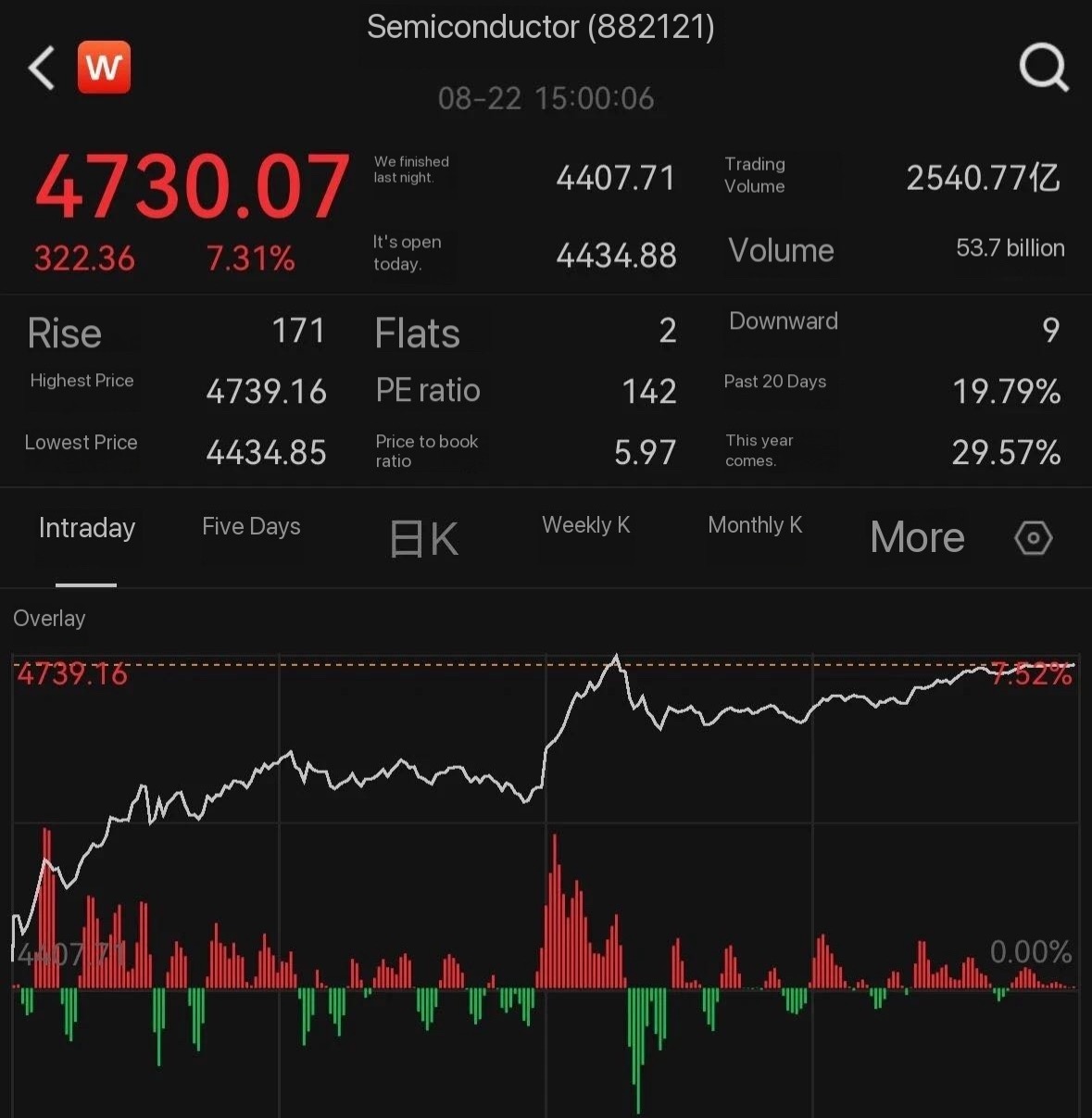

The announcement, made on Thursday, has sparked a surge in Chinese semiconductor stocks, underscoring investor confidence in Beijing’s drive toward technological self-reliance. Shares of Cambricon Technologies, a leading AI chip designer, soared 20% to a record high, while other firms like Semiconductor Manufacturing International Corp. (SMIC) and Huawei-affiliated suppliers also saw significant gains. 27 20 Analysts attribute the rally to DeepSeek’s explicit mention of a “UE8M0 FP8 scale” feature designed for upcoming Chinese chips, which could reduce dependency on U.S.-dominated suppliers like Nvidia.

DeepSeek, founded in 2023 and known for its open-source AI models rivaling global leaders such as OpenAI’s GPT series, emphasized that the V3.1 model enhances efficiency on domestic hardware, including Huawei’s Ascend processors. 17 6 This move aligns with broader national efforts to build a resilient AI ecosystem, as U.S. sanctions since 2022 have limited access to high-end GPUs. Industry observers note that such optimizations could facilitate large-scale training and inference of AI models using entirely indigenous technology, potentially accelerating China’s position in the global AI race.

The upgrade follows reports of delays in DeepSeek’s prior models due to challenges in training on Huawei chips, highlighting the hurdles in transitioning from Nvidia’s ecosystem. 18 However, recent advancements suggest progress, with DeepSeek reportedly achieving competitive inference performance on Ascend chips. This has been interpreted as a signal of resilience, as one analyst stated: “Necessity has driven innovation, allowing Chinese firms to extract more efficiency from available hardware.” 2

Market implications extend beyond immediate stock movements. A successful rollout of next-generation chips could disrupt global supply chains, benefiting domestic players while pressuring Western toolmakers like ASML and Applied Materials, who risk being sidelined from China’s lucrative market. 10 26 Furthermore, DeepSeek’s recruitment drive for semiconductor design talent indicates potential in-house processor development, which could further entrench China’s self-sufficiency. 0 12

Experts caution that while promising, scaling production remains a challenge. Huawei’s Ascend 910C, for instance, offers performance comparable to Nvidia’s H100 but faces capacity constraints in meeting domestic demand. 14 Nonetheless, Beijing’s “whole-of-nation” approach, including substantial state funding and policy support, positions China to potentially leapfrog in AI hardware.

As geopolitical tensions persist, DeepSeek’s advancements underscore a pivotal shift: from adaptation to innovation in China’s semiconductor sector, with far-reaching consequences for global tech dominance. Investors will closely monitor upcoming chip unveilings, expected soon based on the company’s hints.