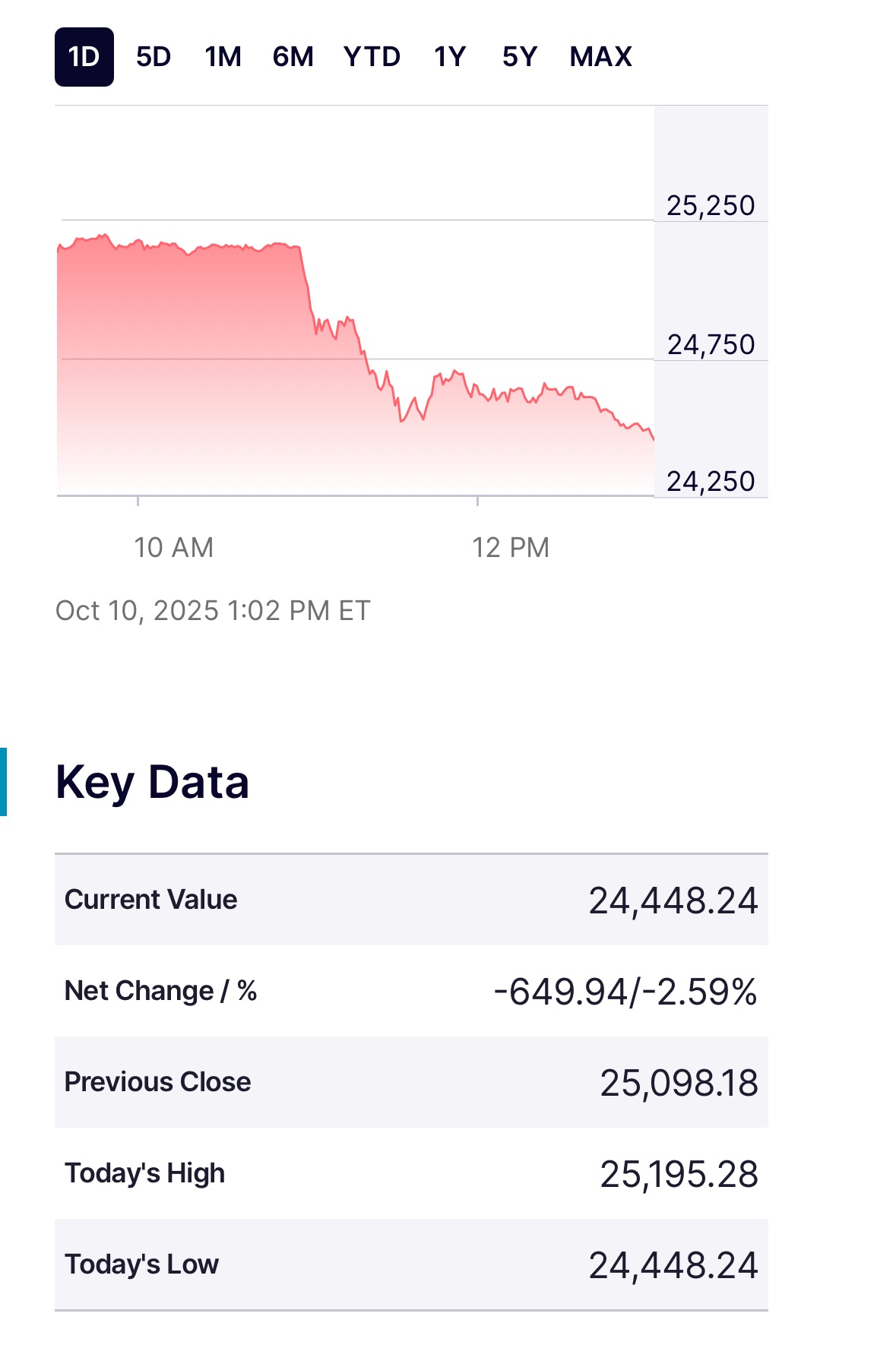

New York, October 11, 2025 – In a sudden and sharp downturn that rattled global markets, US stocks experienced a rapid plunge on October 10, marking one of the steepest intraday drops in recent weeks. The sell-off, triggered by renewed geopolitical friction between the United States and China, wiped out billions in market value and heightened investor anxiety over the fragility of the ongoing economic recovery. As of the close, the Dow Jones Industrial Average had fallen more than 1%, the Nasdaq Composite dropped over 2%, and the S&P 500 declined by more than 1.5%. This event underscores the vulnerability of equity markets to policy shocks, particularly in an environment already strained by a prolonged US government shutdown and lingering concerns about overvalued tech sectors.

The Immediate Catalyst: Trade War Fears Reignite

The downturn accelerated in the afternoon session following statements from President Donald Trump, who accused China of becoming “hostile” and threatened a “massive increase” in tariffs as retaliation for Beijing’s expansion of export controls on rare earth minerals. These materials are critical for high-tech industries, including semiconductors, electric vehicles, and renewable energy technologies, making the move a direct hit to global supply chains. Trump also canceled a planned meeting with Chinese President Xi Jinping, signaling a potential escalation in bilateral tensions that had been simmering since earlier in the year.

This development comes against a backdrop of intensifying US-China rivalry in technology and resources. China has recently tightened customs inspections on imports of advanced AI chips, including those from leading US firms, and imposed new port fees on vessels linked to American entities. Analysts view these actions as part of Beijing’s strategy to bolster domestic self-sufficiency in critical technologies, amid ongoing US restrictions on chip exports. The rare earth controls, in particular, have amplified fears of supply disruptions, as China dominates global production of these elements—accounting for over 80% of the world’s supply.

The market’s reaction was swift and severe, with the S&P 500 tumbling more than 100 points in just 30 minutes after the announcements. Volatility, as measured by the VIX index, spiked sharply, reflecting heightened uncertainty. Safe-haven assets like gold surged toward record highs above $4,000 per ounce, while Treasury yields dipped as investors sought refuge from equities.

Tech Sector Bears the Brunt: Magnificent Seven and Beyond

The technology-heavy Nasdaq bore the heaviest losses, driven by broad weakness in the so-called “Magnificent Seven” stocks that have fueled much of the market’s gains this year. Amazon and Tesla led the declines, each dropping more than 3%, amid concerns that tariff hikes could disrupt their global operations and supply chains. Nvidia and Apple followed closely, shedding over 2%, as fears mounted over restricted access to Chinese markets and components essential for AI and consumer electronics. Microsoft and Alphabet (Google) fell more than 1%, rounding out a collective retreat that erased significant value from the sector.

Chinese-linked stocks, often referred to as “China concept” shares, were hit even harder. The Nasdaq Golden Dragon China Index, which tracks US-listed Chinese companies, plummeted, with Alibaba and Baidu each plunging more than 7%. Electric vehicle maker XPeng dropped nearly 7%, reflecting broader worries about the auto sector’s exposure to trade barriers. Other popular names, including JD.com, NIO, and Pinduoduo, also weakened, contributing to a cascading effect across emerging market equities.

This tech sell-off highlights ongoing debates about valuation bubbles in AI and related industries. Recent warnings from institutions like the Bank of England and the International Monetary Fund have pointed to overstretched multiples in the sector, with some metrics reminiscent of the dot-com era. Despite robust demand for AI infrastructure—evidenced by partnerships like OpenAI’s deal with AMD—the rapid ascent of stocks like Nvidia (up over 150% year-to-date before the drop) has left them susceptible to corrections on negative news.

Broader Market Context: Shutdown and Economic Unease

The plunge occurred amid a ninth day of US government shutdown, which has created a data blackout on key economic indicators such as jobs reports and inflation figures. This lack of visibility has amplified market sensitivity to external shocks, as investors grapple with mixed signals from the Federal Reserve. Officials have indicated a bias toward further rate cuts this year, citing downside risks to the labor market, but cautioned that persistent inflation could temper the pace. The shutdown has also delayed Social Security adjustments and military paychecks, adding to broader economic unease.

Prior to the drop, markets had been on a tear, with the S&P 500 and Nasdaq posting multiple record highs in early October, buoyed by AI optimism and expectations of monetary easing. However, underlying cracks—such as weakening freight volumes, softening oil demand from China, and rising foreclosures—have signaled potential slowdowns in industrial and consumer sectors. Twenty-two US states are reportedly in or near recession, further eroding confidence.

Globally, the ripple effects were immediate. Asian markets opened lower, with Japan’s Nikkei futures down 2%, and European indices following suit. Commodities showed mixed responses: oil prices dipped on concerns over Chinese demand, while copper inventories rose, indicating slackening industrial activity.

Expert Perspectives and Investor Sentiment

Market strategists attribute the severity of the drop to crowded positioning in tech and passive investments, which can exacerbate mechanical selling during volatility spikes. One view is that the event represents a “healthy correction” after prolonged gains, potentially creating buying opportunities for long-term investors. Others warn of prolonged turbulence if trade tensions escalate, drawing parallels to the 2018-2019 US-China trade war that shaved points off global GDP growth.

Investor flows reflect caution: outflows from high-growth tech funds have accelerated, with inflows into defensive sectors like utilities and consumer staples. Hedge funds are increasingly hedging with options and zero-coupon bonds, anticipating further consumer credit strains amid rising debt levels.

Looking Ahead: Risks and Opportunities

As markets digest this episode, attention turns to upcoming catalysts. Q3 earnings season begins next week, with major banks like JPMorgan Chase expected to provide insights into credit quality and net interest margins. Fed speakers may offer guidance amid the data vacuum, while any progress on the government shutdown could restore stability.

On the trade front, resolutions could come quickly if diplomatic channels reopen, but prolonged standoffs risk deeper supply chain disruptions. For tech firms, diversification away from China—through initiatives like “friend-shoring” to allies such as Taiwan and the UAE—may become imperative.

In summary, October 10’s plunge serves as a stark reminder of the interconnectedness of geopolitics and markets. While the US economy remains resilient with low unemployment and steady consumer spending, external pressures like trade wars could tip the balance toward slower growth. Investors are advised to monitor policy developments closely, as the path forward hinges on de-escalation and clarity from global leaders.